April 14, 2020

- Feb 14, 2022

- 10 min read

HOUSTON, April 14, 2020 (GLOBE NEWSWIRE) -- Harvest Oil & Gas Corp. (OTCQX: HRST) (“Harvest” or the “Company”) today announced results for the fourth quarter and full year of 2019 and the filing of its Form 10-K with the Securities and Exchange Commission (“SEC”). In addition, Harvest announced its 2019 year-end proved reserves and provided guidance for 2020. Key Highlights

Average daily production was 53.1 MMcfe for the fourth quarter of 2019

Made a cash distribution of $7.00 per share in October 2019

Entered into a new $10 million credit facility in October 2019

In December 2019, closed on the sale of substantially all of Harvest’s remaining oil and natural gas properties in the Barnett Shale for $6.2 million, net of preliminary purchase price adjustments

In December 2019, closed on the sale of substantially all of Harvest’s oil and natural gas properties in the Permian Basin for total consideration of $2.9 million, net of purchase price adjustments, and expect a subsequent closing for total consideration of $0.1 million in the second quarter of 2020, subject to customary purchase price adjustments

In March 2020, signed a purchase and sale agreement to sell all of Harvest’s oil and natural gas properties in Michigan for a purchase price of $4.8 million, subject to an adjustment based on the value of certain derivative contracts and other customary purchase price adjustments, with an expected closing during the second quarter of 2020

In conjunction with divestitures during the fourth quarter, unwound certain commodity derivative contracts in January 2020 for cash settlements received of $1.1 million

As of March 31, 2020, Harvest had repurchased 12,139 shares of its outstanding common stock under the previously announced share repurchase program

The Company continues to review strategic alternatives following the divestiture of significant assets during 2019. The Company is actively considering the potential divestiture of all of its remaining assets as well as a potential sale or merger of the Company. In addition, Harvest is pursuing options to reduce its overall cost structure to more closely align with its asset base.

Fourth Quarter 2019 Results

Fourth Quarter Third Quarter$ in millions unless noted otherwise 2019 2019Average daily production (MMcfe/d) 53.1 98.1 Total revenues 16.1 23.2 Total assets (1) 180.2 289.9 Net loss (22.1) (19.5)Adjusted EBITDAX (2) (0.6) 9.7 Total debt (1) - - Net cash provided by operating activities 3.7 14.9 Additions to oil and natural gas properties (3) (0.8) 0.3

(1) As of December 31, 2019 and September 30, 2019

(2) Adjusted EBITDAX is a non-GAAP financial measure and is described in the table below under “Non-GAAP Measures”

(3) Represents cash payments during the period

For the fourth quarter of 2019, Harvest reported a net loss of $(22.1) million, or $(2.17) per basic and diluted weighted average share outstanding, compared to a net income of $34.3 million, or $3.41 per basic and diluted weighted average share outstanding, for the fourth quarter of 2018. For the third quarter of 2019, Harvest reported a net loss of $19.5 million, or $(1.93) per basic and diluted weighted average share outstanding. Included in 2019 fourth quarter net loss were the following items:

$13.5 million of impairment charges primarily related to proved oil and natural gas properties located in Michigan, the Barnett Shale, and the Mid-Continent area,

$4.4 million of non-cash losses on commodity derivatives,

$0.4 million loss on sales of oil and natural gas properties,

$0.4 million of stock-based compensation costs contained in general and administrative expenses,

$0.5 million of divestiture and transaction related expenses contained in general and administrative expenses, and

$0.1 million of litigation settlement expenses contained in general and administrative expenses.

Production for the fourth quarter of 2019 was 3.7 Bcf of natural gas, 121 Mbbls of oil and 75 Mbbls of natural gas liquids (“NGLs”), or 53.1 million cubic feet equivalent per day (Mmcfe/day). This represents a 63 percent decrease from the fourth quarter of 2018 production of 144.9 Mmcfe/day and a 46 percent decrease from the third quarter of 2019 production of 98.1 Mmcfe/day. The decrease in production from the fourth quarter of 2018 was primarily due to divestitures in 2019 in the Barnett Shale, the San Juan Basin, the Mid-Continent area and the Monroe Field in Northern Louisiana. The decrease in production from the third quarter of 2019 was primarily due to the Barnett Shale, Mid-Continent area and the Monroe Field divestitures that closed during the third and fourth quarters of 2019.

Adjusted EBITDAX for the fourth quarter of 2019 was $(0.6) million. The decrease in Adjusted EBITDAX from the fourth quarter of 2018 was primarily attributable to the divestitures that closed in 2019 and lower realized natural gas prices, partially offset by an increase in cash settlements received on commodity derivative contracts. The decrease in Adjusted EBITDAX from the third quarter of 2019 was primarily attributable to the Barnett Shale, Mid-Continent area and Monroe Field divestitures that closed during the third and fourth quarters of 2019 and a decrease in cash settlements received on commodity derivative contracts and on termination of commodity derivative contracts in conjunction with divestitures, partially offset by higher natural gas and natural gas liquids prices, and a decrease in general and administrative expenses. Adjusted EBITDAX is a non-GAAP financial measure and is described in the below table under “Non-GAAP Measures.”

Full Year 2019 Results

$ in millions unless noted otherwise 2019 2018 (1)Average daily production (MMcfe/d) 99.9 170.5 Total revenues (2) 113.8 249.6 Total assets (3) 180.2 534.5 Net loss (2)(4) (138.3) (586.6)Adjusted EBITDAX (2)(5) 28.3 92.0 Total debt (3) - 115.0 Net cash provided by operating activities 47.7 67.2 Additions to oil and natural gas properties (6) 1.3 57.1

(1) All amounts reflect the combined results of five months ended May 31, 2018 (Predecessor) and seven months ended December 31, 2018 (Successor)

(2) Includes royalty adjustment of $5.0 million in 2018. See Note 14 of the Notes to Consolidated Financial Statements included under “Item 8. Financial Statements and Supplementary Data” contained in Harvest’s Form 10-K filed April 14, 2020. Excluding this royalty adjustment, for 2018, total revenue would have been $254.6 million, net loss would have been $581.6 million and Adjusted EBITDAX would have been $97.0 million.

(3) As of December 31, 2019 and 2018

(4) Includes $589.6 million of reorganization items, net, in 2018

(5) Adjusted EBITDAX is a non-GAAP financial measure and is described in the attached table under “Non-GAAP Measures”

(6) Represents cash payments during the period

For 2019, Harvest reported a net loss of $138.3 million compared to a net loss of $586.6 million for 2018. Included in net loss for 2019 were the following items:

$129.1 million of impairment charges related to the sale of proved oil and natural gas properties located in the Barnett Shale, San Juan Basin, Permian Basin, Mid-Continent area, and the Monroe Field, and oil and natural gas properties located in Michigan, which were under a purchase and sale agreement entered into in March 2020,

$16.6 million of non-cash losses on commodity derivatives,

$4.6 million of gain on equity securities,

$2.5 million of stock-based compensation costs contained in general and administrative expenses, and

$2.4 million of divestiture and transaction related expenses contained in general and administrative expenses.

Production for 2019 was 25.5 Bcf of natural gas, 591 Mbbls of oil and 1.2 Mmbbls of natural gas liquids, or 99.9 Mmcfe/day. This represents a 41 percent decrease from the 2018 production of 170.5 Mmcfe/day. The decrease from 2018 production was primarily due to the divestitures of oil and natural gas properties in 2018 and 2019.

Adjusted EBITDAX for 2019 was $28.3 million, a 69 percent decrease as compared to 2018. The decrease in Adjusted EBITDAX as compared to 2018 is primarily due to divestitures that closed in 2018 and 2019 and a decrease in realized oil, natural gas, and natural gas liquids prices, partially offset by an increase in cash settlements received on commodity derivative contracts, a decrease in general and administrative expenses and an increase in other income.

Commodity Hedges

In January 2020, Harvest terminated the following hedge positions in connection with divestitures that closed during the fourth quarter of 2019 at a net gain of $1.1 million.

Details regarding Harvest’s total current hedge position may be found in the Total Current Hedge Position table at the end of this press release.

Year-end 2019 Estimated Net Proved Reserves

Harvest’s year-end 2019 estimated net proved reserves were 156 Bcfe. Approximately 76 percent were natural gas, 21 percent were crude oil and 3 percent were natural gas liquids. As specified by the SEC, the prices for oil, natural gas and natural gas liquids were the average prices during the year determined using the price on the first day of each month. The prices utilized in calculating the Company’s total estimated proved reserves at December 31, 2019 were $55.69 per Bbl of oil and $2.58 per MMBtu of natural gas. At December 31, 2019, our proved reserves had a standardized measure of discounted future net cash flows of $106.9 million and a present value of future net pre-tax cash flows attributable to estimated net proved reserves, discounted at 10 percent per annum (“PV-10”) of $110.5 million based on SEC pricing. PV–10, is a computation of the standardized measure of discounted future net cash flows on a pre–tax basis and is computed on the same basis as standardized measure but does not include a provision for federal income taxes, Texas gross margin tax or other state taxes. PV–10 is considered a non–GAAP financial measure under the regulations of the SEC. We believe PV–10 to be an important measure for evaluating the relative significance of our oil and natural gas properties. We further believe investors and creditors may utilize our PV–10 as a basis for comparison of the relative size and value of our reserves to other companies. PV–10, however, is not a substitute for the standardized measure. See the attached table under “Non-GAAP Measures” for a reconciliation of standardized measure to PV-10. Our PV–10 measure and standardized measure do not purport to present the fair value of our reserves.

For comparative purposes, utilizing NYMEX forward closing prices for oil and natural gas at April 8, 2020 for January 1, 2020 through December 31, 2031, total proved reserves at December 31, 2019 were 152.3 Bcfe, with a PV–10 of $78.7 million, a decrease of 3.5 Bcfe versus SEC reserves and $31.8 million versus PV–10 using SEC prices. The unweighted average of the NYMEX strip prices used were $44.23 per Bbl of oil and $2.46 per MMBtu of natural gas. NYMEX forward strip-based proved reserves were calculated based on the SEC proved reserves estimation methodology, but applying NYMEX forward strip prices rather than SEC prices. We believe that investors and creditors may utilize our NYMEX strip-based PV-10 as a basis for comparison of the relative size and value of our reserves to other companies. The PV–10 of our NYMEX forward strip-based reserves is not a substitute for the standardized measure and does not purport to present the fair value of our reserves.

Guidance for 2020

Annual Report on Form 10-K

Harvest’s financial statements and related footnotes are available in the 2019 Form 10-K, which was filed today and is available through the Investor Relations/SEC Filings section of the Harvest website at http://www.hvstog.com.

Investor Presentation

An updated investor presentation will be posted to the Investor Relations section of the Harvest website on April 14, 2020.

About Harvest Oil & Gas Corp.

Harvest is an independent oil and gas company engaged in the efficient operation and development of onshore oil and gas properties in the continental United States. The Company’s assets consist primarily of producing and non-producing properties in the Appalachian Basin (which includes the Utica Shale) and Michigan. More information about Harvest is available on the internet at https://www.hvstog.com.

Forward Looking Statements

This press release contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends affecting the financial condition of its business. These forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond its control. Please read the Company’s filings with the Securities and Exchange Commission, including “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2019 and other public filings and press releases for a discussion of risks and uncertainties that could cause actual results to differ from those in such forward-looking statements. These risks include, but are not limited to, risks relating to pending asset sales, including risks relating to the consummation of such sales in accordance with their terms or at all, our inability to control our contract operator, EnerVest Operating, L.L.C., outside of the parameters of the Services Agreement, our ability to obtain needed capital or financing on satisfactory terms, fluctuations in prices of oil, natural gas and natural gas liquids and the length of time commodity prices remain depressed, our ability to maintain production levels through development drilling, risks associated with drilling and operating wells, the availability of drilling and production equipment, changes in applicable laws and regulations that adversely affect our operations and general economic conditions. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “indicate” and similar expressions are intended to identify forward-looking statements. All statements other than statements of current or historical fact contained in this press release are forward-looking statements. Although the Company believes that the forward-looking statements contained in this press release are based upon reasonable assumptions, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise.

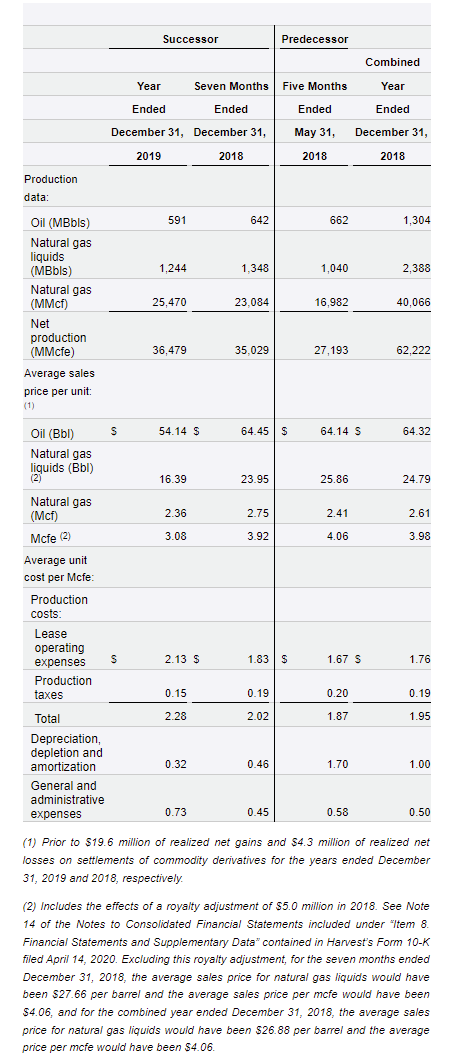

Operating Statistics

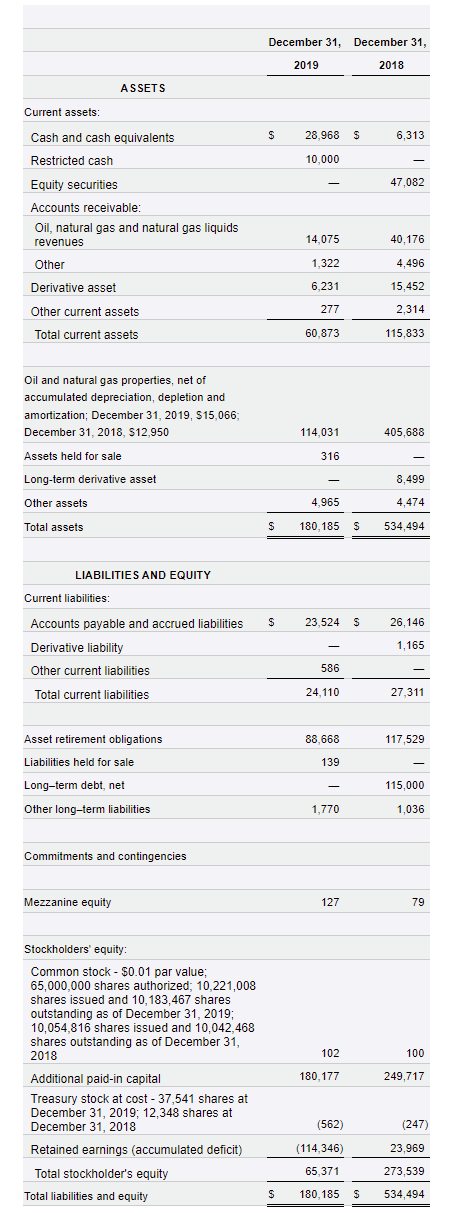

Consolidated Balance Sheets ($ in thousands, except number of shares)

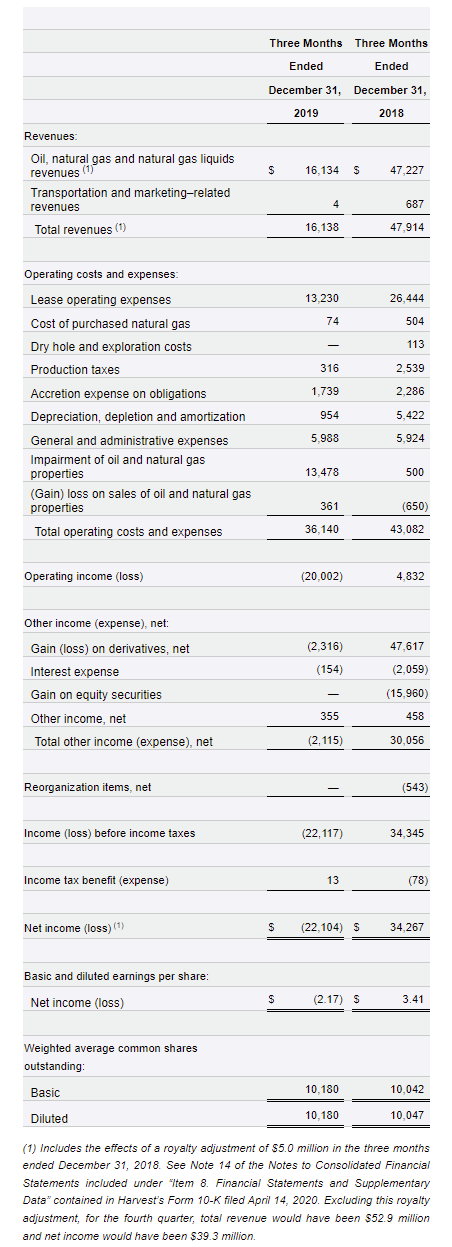

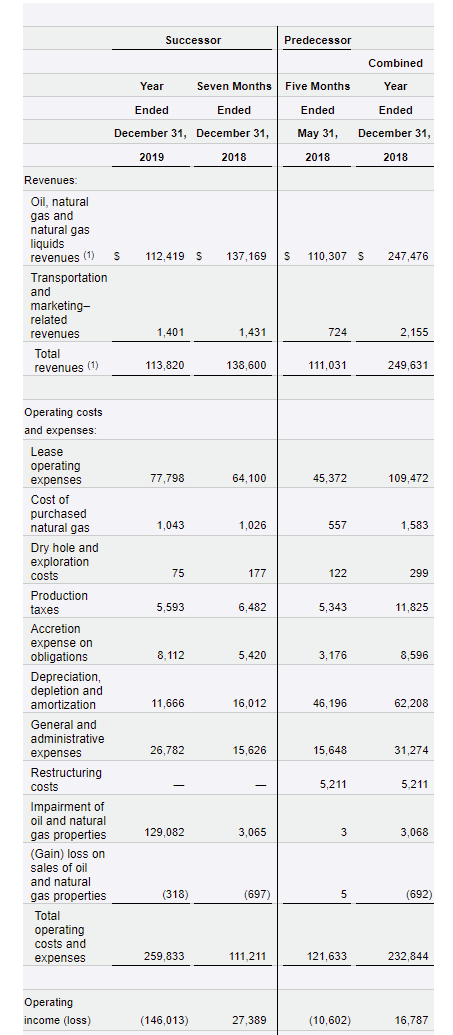

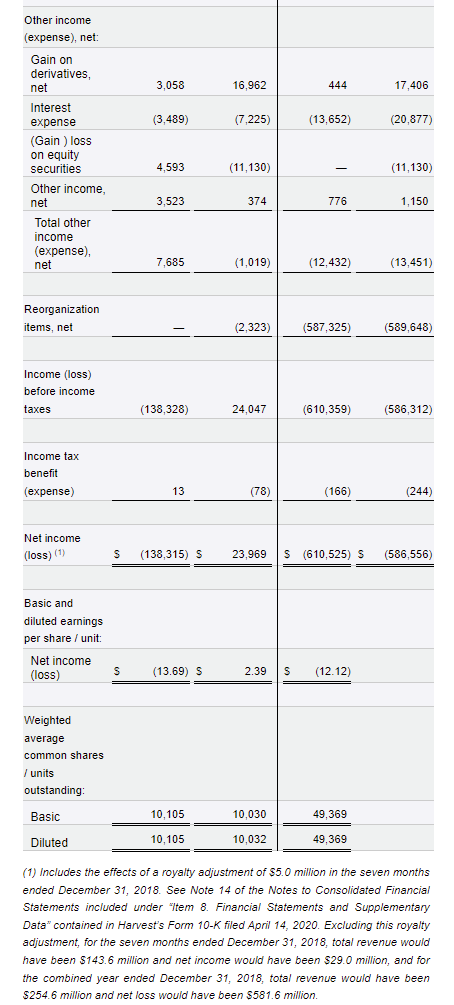

Consolidated Statements of Operations ($ in thousands, except per share/unit data)

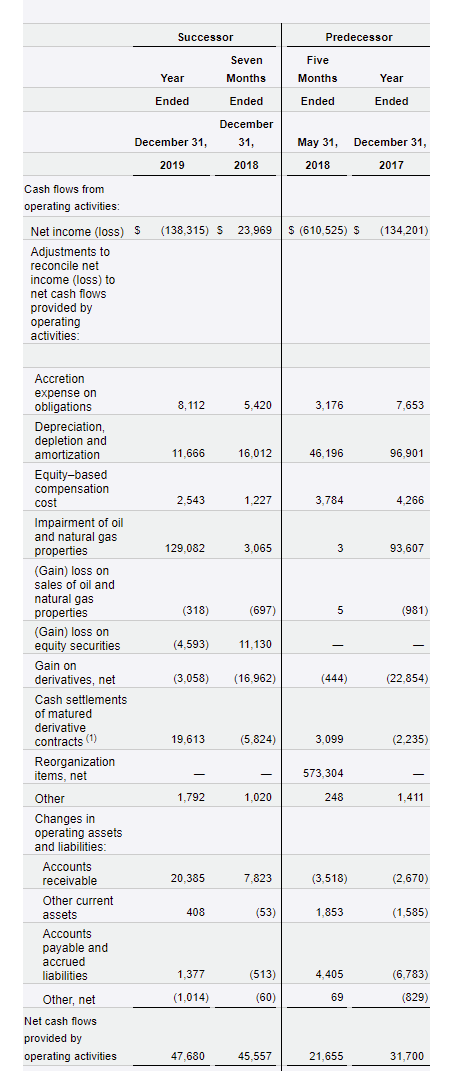

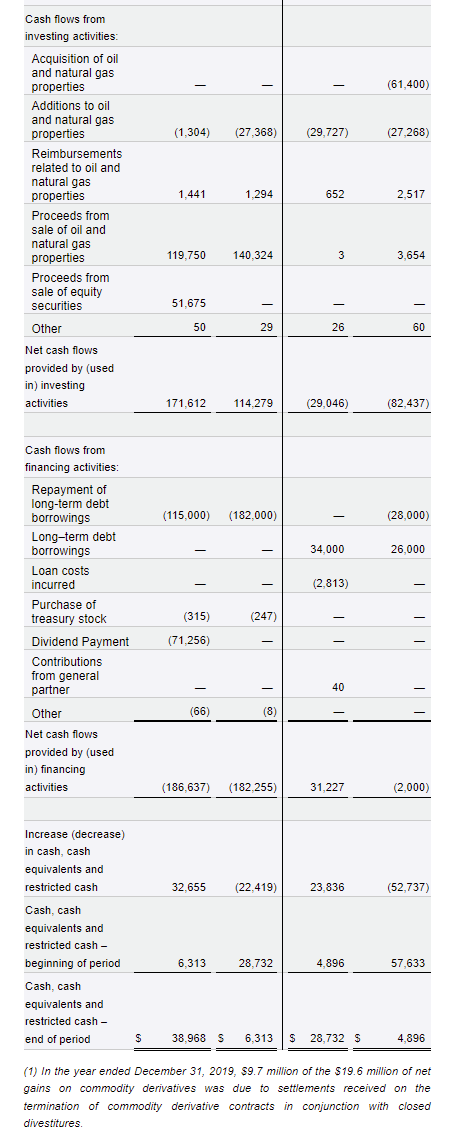

Consolidated Statements of Cash Flows ($ in thousands)

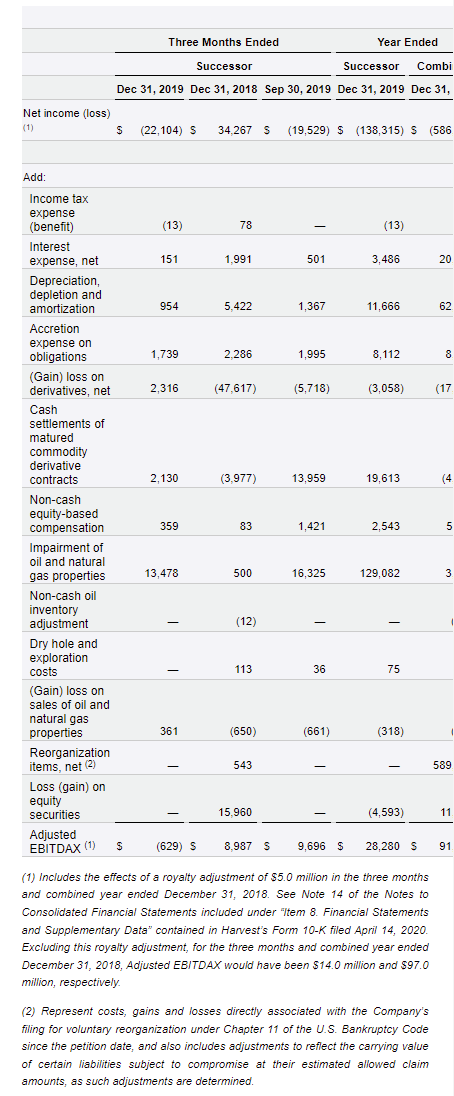

Non-GAAP Measures

We define Adjusted EBITDAX as net income (loss) plus income tax expense (benefit); interest expense, net; depreciation, depletion and amortization; accretion expense on obligations; (gain) loss on derivatives, net; cash settlements of matured commodity derivative contracts; non-cash equity-based compensation; impairment of oil and natural gas properties; non-cash oil inventory adjustment; dry hole and exploration costs; (gain) loss on sales of oil and natural gas properties; reorganization items, net; and loss (gain) on equity securities.

Adjusted EBITDAX is used by the Company’s management to provide additional information and statistics relative to the performance of the business, including (prior to the creation of any reserves) the cash return on investment. The Company believes this financial measure may indicate to investors whether or not it is generating cash flow at a level that can support or sustain quarterly interest expense and capital expenditures. Adjusted EBITDAX should not be considered as an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDAX excludes some, but not all, items that affect net income and operating income, and this measure may vary among companies. Therefore, Harvest’s Adjusted EBITDAX may not be comparable to similarly titled measures of other companies.

Reconciliation of Net Income (Loss) to Adjusted EBITDAX ($ in thousands)

Reconciliation of Standardized Measure to PV-10 at December 31, 2019 ($ in millions)

Total Current Hedge Position

Harvest Oil & Gas Corp., Houston, TX Ryan Stash, Chief Financial Officer 713-651-1144 hvstog.com

Comments